Dave Stockman on the tyranny of the PHD’s.

Sad to say, you haven’t seen nothin’ yet. The world is drifting into financial entropy, and it is going to get steadily worse. That’s because the emerging stock market slump isn’t just another cyclical correction; it’s the opening phase of the end-game.

That is, the end game of the PhD Tyranny.

During the last two decades the major central banks of the world have been colonized lock, stock and barrel by Keynesian crackpots. These academic scribblers and power-hungry apparatchiks have now pushed interest rate repression, massive monetization (QE) and relentless rigging of the financial markets to the limits of sanity and beyond. Honest, market-driven price discovery is dead as a doornail.

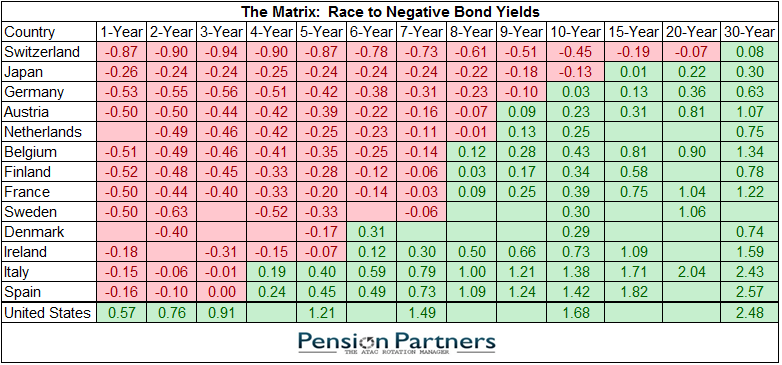

No more proof is needed than the “matrix” below. The very thing that financial history proves, above all else, is that governments can’t be trusted to honor their debts. And that cardinal fact is supposed to be embodied in the yield.

In fact, modern welfare state democracies have a veritable fiscal death wish.

What else can you call Japan’s announcement to defer yet again an increase in the consumption tax? Its public debt is already at 240% of GDP, even as its tax-paying population is rapidly streaming toward it’s national old age home.

At a 135% debt-to-GDP ratio, Italy is not far behind. It’s economy is still smaller than it was in 2007, its banking system has more than $200 billion of bad debt, its public sector squanders more than 50% of GDP and its politically fractured and corruption-ridden government is paralyzed.

Yet these are only advanced cases of the universal fiscal condition of the world’s sovereigns. With $80 trillion of public debt and unfunded entitlement liabilities, the US government is hardly more solvent than the socialist basket cases of Europe.

Once upon a time, the tendency of politicians to bankrupt the state was at least partially held in check by the fear of bond vigilantes, and the prospect of soaring interest costs on the public debt. I happened to be there during one such episode, when the 10-year treasury note required a 15% coupon.

It was enough to cause even Democrats to denounce deficits!

That is, at least until the GOP took a powder on social security and other entitlement reforms. At length, a tax-cut bidding war and DOD war spending spree supplanted most of the old-time fiscal religion. And then Greenspan finished the job when he threw in the towel on monetary discipline in 1994.

Once upon a time, too, the interest rate on debt reflected compensation for credit risk and inflation—-and a real return to boot.

At the moment, however, “investors” aren’t getting paid for any of these costs. Instead, thanks to the mad-men running our central banks they are actually being forced to pay governments to borrow.

Moreover, that’s not an aberrant condition in the far recesses of the global bond market. There is now $10 trillion of sovereign debt securities with negative yields—–and that figure is growing by the week as it cascades across government bond markets and out the maturity spectrum.

There could be nothing more perverse than for the central banking branch of the state to destroy the very government bond market on which modern state finances ultimately depend. But that’s exactly what they are doing, and the end-game could not have been expressed more colorfully than in the recent musings of the once and former bond king, Bill Gross:

Bill Gross, the manager of the $1.4 billion Janus Global Unconstrained Bond Fund, warned central bank policies that pushed trillions of dollars into bonds with negative interest rates will eventually backfire violently.

“Global yields lowest in 500 years of recorded history,” Gross, 72, wrote Thursday on the Janus Capital Group Inc. Twitter site. “$10 trillion of neg. rate bonds. This is a supernova that will explode one day.”

http://davidstockmanscontracorner.com/tyranny-of-the-phds/

The problem is that the academics in government are so far from the reality of the real world economy that they don’t have enough connection to it to understand just what they need to look and why their models are doomed to failure.

That doesn’t stop them, though, from making recommendations that have disastrous consequences for the very people they are trying to help. As far as fast food automation and other similar service automations, every rise in the minimum wage only makes them inevitable. A system that doesn’t pay at $10.00/hr just might at $15.00/hr and for the employees the real minimum wage is always zero. Yet the “experts” keep making recommendations like this. complete with fancy charts, graphs and computer models showing how smart they are.

Below is the abstract of this this 2015 paper by Robert Pollin and Jeannette Wicks-Lim. (HT Walter Williams) It is an ideal justification for my insistence that academics who demand that the state raise the minimum wage put their own money where their mouths are before any of the rest of us pay these academics any attention.

ABSTRACT: This paper considers the extent to which U.S. fast-food businesses could adjust to an increase in the federal minimum wage from its current level of $7.25 per hour to $15 an hour without having to resort to reducing their workforces. We consider this issue through a set of simple illustrative exercises, whereby the U.S. raises the federal minimum wage in two steps over four years, first to $10.50 within one year, then to $15 after three more years. We conclude that the fast-food industry could absorb the increase in its overall wage bill without resorting to cuts in their employment levels at any point over this four-year adjustment period. Rather, we find that the fast-food industry could fully absorb these wage bill increases through a combination of turnover reductions; trend increases in sales growth; and modest annual price increases over the four-year period. Working from the relevant existing literature, our results are based on a set of reasonable assumptions on fast-food turnover rates; the price elasticity of demand within the fast-food industry; and the underlying trend for sales growth in the industry. We also show that fast-food firms would not need to lower their average profit rate during this adjustment period. Nor would the fast-food firms need to reallocate funds generated by revenues away from any other area of their overall operations, such as marketing.

The authors are above not doing economics, properly speaking. Instead, they offer business advice – or, rather, present themselves as possessing knowledge and information that is salable as business advice. The authors write as if they are management or business-operations consultants rather than economists. Pollin and Wicks-Lim here implicitly assert that their information on the details the state of the market and their knowledge of the particulars of how to run actual, real-world businesses are so real, full, and trustworthy that we should accept their conclusion that higher minimum wages will not cause businesses to change their operations in ways that result in fewer hours of paid work for low-skilled workers.

The funny thing is that when the geniuses invest their own money they tend to not do so hot. Like the professors of Tokyo’s universities after they retired from MITI they seem to lack the knowledge skills to reliably pick the winner once they leave the government’s picking winners and losers. If John Cowperthwaite and Hong Kong were the perfect example of what happens when government stops meddling and unleashed opportunity then Japan and MITI are the perfect examples of what happens when you don’t.

If you are so smart, why aren’t you rich? MITI version

It’s time to dig up the pile of crap that modern economics has become. As it stands the discipline if economics is stuck in the pile of it’s Keynesian excrement. The people in charge of the financial institutions in the US are now completely unable to undo the damage that they have already done and return market discipline to the financial markets. The system of highly trained experts running the financial markets has failed and it’s time to sweep them way before they wreck the country.

http://www.newsmax.com/LarryKudlow/overthrow-establishment-fix-economy/2016/06/16/id/734315/

If the country is to survive, things need to change. The only alternative is a slow slide to poverty. Which seems to be the place that the people in charge are determined to send us.

For more on the dysfunctional economy click Here or on the tag below.